In currently’s fast-paced and unpredictable organization atmosphere—Specifically over the various markets of the center East and Africa—getting access to precise, responsible, and timely information regarding the companies you are doing small business with is no more optional. Organization Credit Experiences became An important tool for enterprises aiming to deal with credit history threat successfully, avoid highly-priced defaults, and make informed selections.

one. Make Self-confident Credit Selections with Dependable Facts

An extensive business credit score report presents an in-depth overview of a company’s money balance, operational background, payment behavior, and lawful standing. With this particular details at your fingertips, your team can:

Evaluate creditworthiness ahead of extending terms or offering financing

Determine pink flags like late payments, legal disputes, or deteriorating financials

Mitigate hazard by customizing credit score restrictions and phrases for every consumer or supplier

This is especially valuable from the MEA region, wherever publicly obtainable economical info is commonly restricted or inconsistent.

2. Enrich Danger Management Across Borders

Executing company across a number of international locations in the center East and Africa usually means coping with diverse regulatory devices, amounts of transparency, and economic problems. Corporation credit rating stories provide you with a standardized possibility profile, encouraging you to definitely:

Assess corporations across marketplaces applying dependable credit rating scoring

Fully grasp community context, for example alterations in company laws or country possibility

Make a regional credit score plan depending on real details in lieu of assumptions

3. Guard Your organization from Payment Defaults

One of several top motives businesses go through cash circulation complications is due to delayed or unpaid invoices. Organization credit rating experiences help minimize this possibility by offering:

Payment background insights, displaying how immediately a business pays its suppliers

Credit score trends, indicating enhancing or worsening conduct with time

Alerts and updates, therefore you’re knowledgeable of any important improvements that will have an impact on payment dependability

Staying proactive, as an alternative to reactive, helps you keep away Company Credit Report from pointless losses and retain a healthy stability sheet.

four. Streamline Onboarding and Research

When bringing on new customers, partners, or suppliers, a corporation credit score report simplifies and accelerates your homework method. With only one document, you may assessment:

Business registration and ownership framework

Key money ratios and once-a-year turnover

Bankruptcy information, authorized judgments, and regulatory flags

This hastens selection-earning whilst guaranteeing compliance with inside hazard policies and external laws for example anti-dollars laundering (AML) standards.

five. Strengthen Negotiating Energy and Strategic Organizing

A transparent comprehension of your counterpart’s economic overall health will give you leverage in negotiations. You could:

Regulate payment phrases, for example requiring progress payment or shorter credit rating cycles

Prepare for contingencies, by figuring out suppliers or clients who may existing chance

Prioritize partnerships with organizations which are economically steady and low possibility

While in the MEA location, wherever economic shifts can arise rapidly, this foresight is very important to safeguarding your enterprise pursuits.

six. Help Portfolio Checking and Reporting

If you’re controlling a large portfolio of clientele, suppliers, or borrowers, keeping track of each entity’s credit score wellbeing can be a main problem. Firm credit rating stories assist you:

Keep track of adjustments after a while with periodic updates

Section your portfolio by hazard amount, industry, or geography

Make actionable insights for interior reporting or board-amount conversations

This permits for greater strategic scheduling, compliance reporting, and In general credit history chance governance.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Amanda Bynes Then & Now!

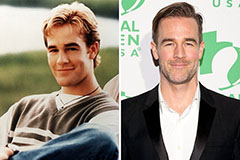

Amanda Bynes Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!